Provided the fund gains in value over the long term, you'll profit from your purchases during short-term price declines. For example, your money will buy more units of a mutual fund when prices are low and fewer units when prices are high. Investing smaller amounts in mutual funds over time - or "dollar-cost averaging" - can mean lower average costs than if you make infrequent purchases. How can I lower the average cost of investing? You can invest with pre-authorized contributions of as little as $25 a month. With a CIBC Regular Investment Plan, money will be automatically withdrawn from your account and invested in a range of CIBC investment solutions. A regular investment plan allows you to choose when and how often you make contributions - ensuring you make investing a priority.

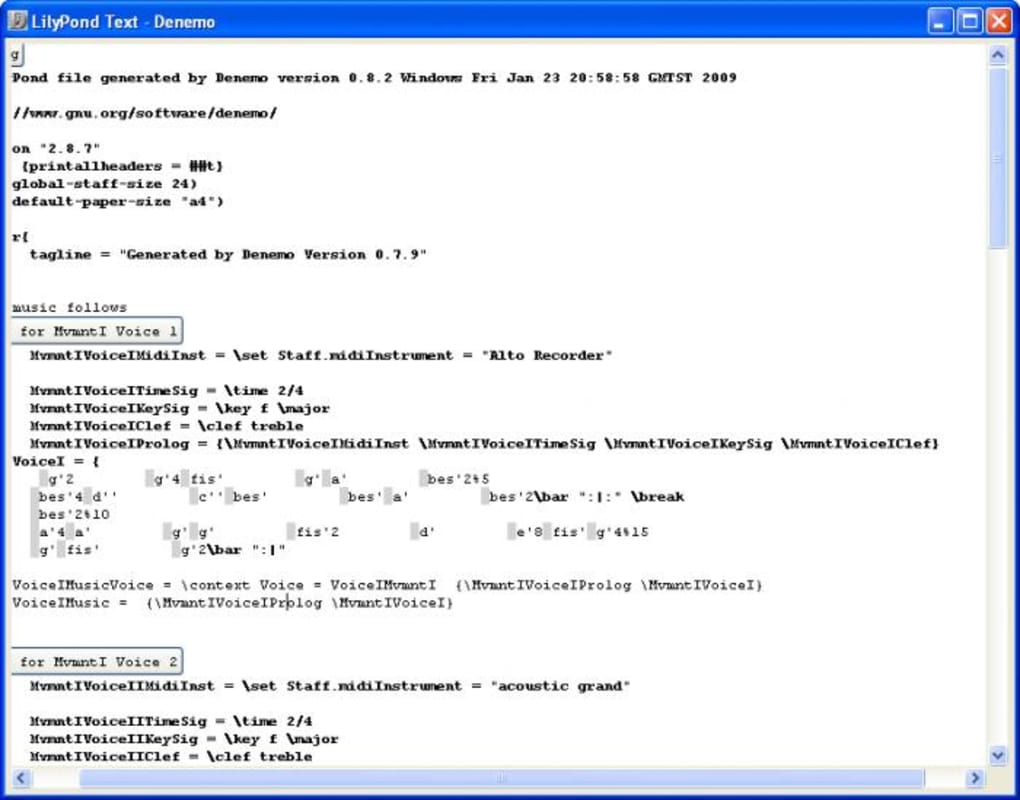

It's generally much easier to come up with a smaller amount to invest on a monthly or weekly basis than to make a large, lump-sum contribution. A diversified portfolio typically holds a combination of savings, income and growth investments. The mix of investments within your portfolio is also known as your portfolio's asset allocation. (For example, if you started investing at 25 years old, you would need to contribute $93 every two weeks.) This chart demonstrates the bi-weekly investment needed to reach $500,000 by the age of 65. Compounding is money multiplying itself by earning a return on the return. Taking advantage of the effects of "compounding" is one of the best ways to make your money work for you. To better understand yourself as an investor, consider your: risk tolerance, investment knowledge, investment objectives, gross annual income, approximate net worth and investment time horizons. Finding a balance between risk and reward that you're comfortable with - and that's appropriate for your investment time frame - is an important first step to successful investing. While risk sounds like something to avoid, there can be an upside - greater risk may offer the opportunity for greater rewards over the long term. In addition, every investor has a different comfort level with investment risk. Some are short-term, like saving for a vacation or a car, while others are long-term, like retirement. We all have different investing goals and different time frames for achieving them. Here are six investing principles to follow: Whether you are saving for a home, retirement, or your child's education, you want a plan that will help your money grow. Your personal circumstances will affect your decisions every step of the way. Successful investing involves making choices that meet your unique needs today and your financial goals for the future. Denemo 2.2 will not open macOS 10.14.What should I think about before investing?

#MAC DENEMO NOT OPENING MAC#

MacPorts package, which hopefully someone with a Mac will be able to do I understand that there is some further work to do to make this into a Mailing list discussion: the result is that there are instructions for doing

#MAC DENEMO NOT OPENING MAC OS#

Getting Denemo working for recent Mac OS has been the subject of a recent

0 kommentar(er)

0 kommentar(er)